Interest rates

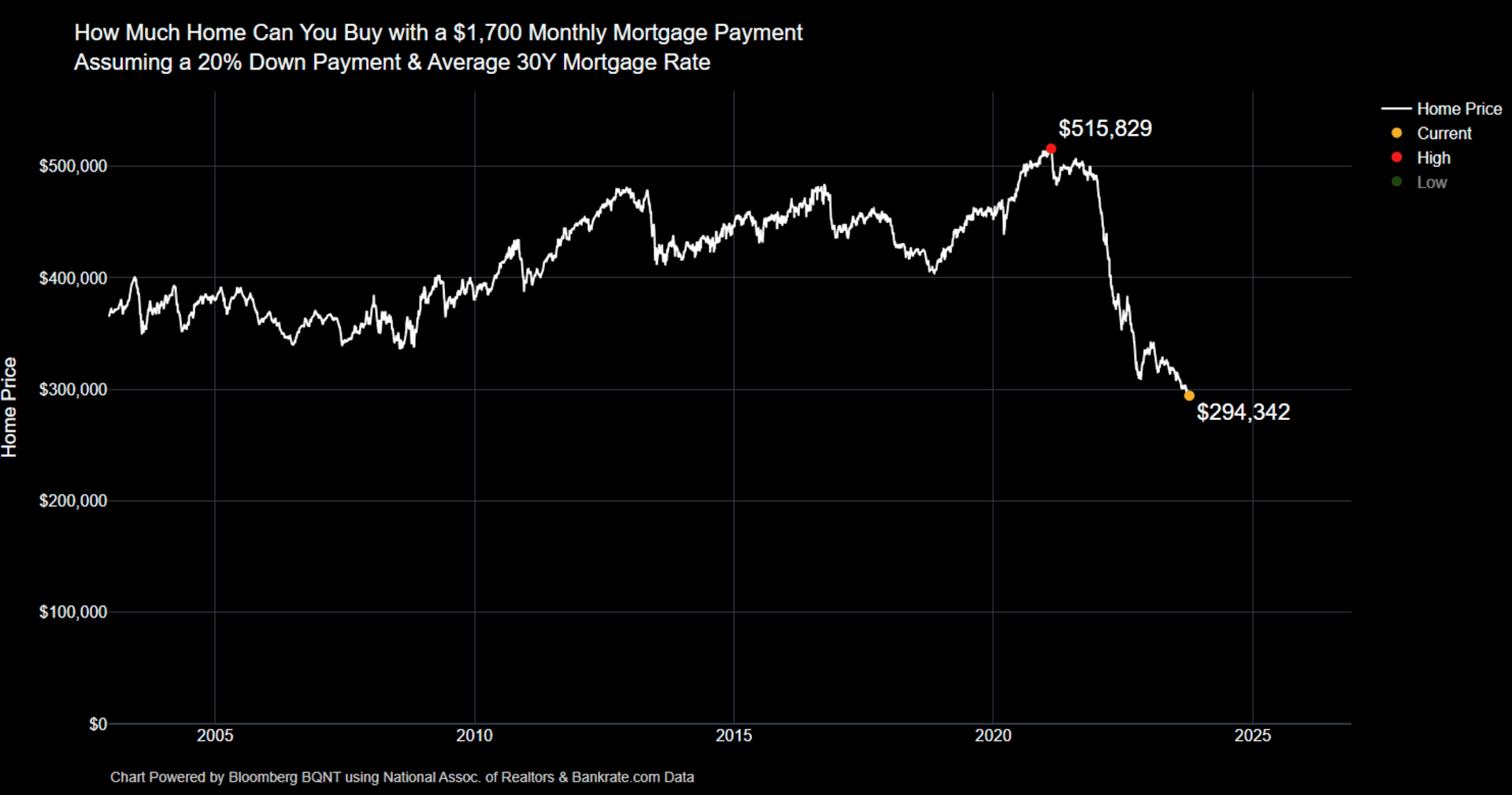

The most obvious way for central bankers to bring the annual rate of inflation back to 2% is to raise interest rates, but they have other methods to tighten financial conditions. Investors are currently very worried about the prospect that inflation won't return to target for the foreseeable, and that interest rates will have to remain elevated for much longer than current forecasts suggest. Dropping the slightest hint that this might be the case, as Federal Reserve chair Jerome Powell and his colleagues have done on several occasions recently, prompts investors to sell off long duration government bonds, namely ten-year and 30-year US treasuries. Yields on the bonds rise as values fall – Liam Bailey explores this relationship in a little more detail here. The yield on benchmark ten-year US treasuries touched 5% last week, the highest in 16 years after Powell said that interest rates were not "too tight" at present levels. The 30-year treasury hit 5.1%,a fresh 2007-era high. This was not a hawkish speech, either. “Given the uncertainties and risks, and how far we have come, the committee is proceeding carefully,” Powell said, which is a reasonable hint that the Fed is inclined to hold rates steady at its next meeting that runs to November 1st.Deteriorating affordability Powell acknowledged that investors' shifting interpretations of the Fed's thinking is feeding through to the economy and adds a large dose of uncertainty to decision making moving forward:"Actual and expected changes in the stance of monetary policy affect broader financial conditions, which in turn affect economic activity, employment and inflation. Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy."For an illustration of how all this impacts consumers, look no further than the housing market. The average US 30-year mortgage rate hit 8% last Wednesday morning, the highest level since mid-2000 and up from as low as 3% just two years ago. The impact on affordability has been huge - a $1,700 monthly mortgage payment on the average 30y mortgage rate would have netted you a $515,829 home a couple of years ago. The surge in mortgage rates has pushed that down to $294,342, see chart below from Bloomberg chief economist Michael McDonough.“When 30-year mortgages and car loans cost you 8 per cent it will impact consumer behavior,” Jonathan Gray, president of Blackstone, said in an interview with the Financial Times. “Growth has been remarkably resilient, but if you keep policy this tight, this long, invariably you will cause the economy to slow down.”